37+ how to improve mortgage credit score

Apply Get Pre-Approved Today. Apply for a Home Equity Loan Today.

Moneycounts A Financial Literacy Series Ppt Download

Try to keep it below 30 Rossman said.

. Web 2 days agoGood credit displays a history of repaying your debts and shows that you havent taken out more debt than what your income allows. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web The best way to improve your credit score is to avoid late paymentsparticularly on student loans credit cards and other types of debts that get.

Find The Best Home Improvement Loan Rates. Check Your Credit Reports For Accuracy Trying to improve your credit without checking your credit report. 35 of the credit score is dependent on your payment history.

Top Lenders Reviewed By Industry Experts. Web Thats an extra 1568520 over the life of the mortgage just by raising the interest rate by a quarter of a percent. Compare Loans Calculate Payments - All Online.

Ad Increase your FICO Score Get Credit for the Bills Youre Already Paying. Compare the Best Conventional Home Loans for March 2023. The credit bureaus might rate you higher if you have a longer history of paying.

Web Here are five steps to help you qualify for a mortgage and get the home you want. It sounds like Im being impatient and have to wait for my monthly report to pull to see the updated mortgage scores. Start by paying down balances on credit cards and loans as.

Ad Trying to Decide How to Finance Your Home Improvement. First check your credit history You are allowed one free credit report a year from the three main credit-scoring. You Can Increase your FICO Score for Free.

Web You can take several moves to improve your score. Web You might be able to improve your credit score by self-reporting the payments you make toward rent and utility bills. Keeping an eye on your credit card balances can also increase your score.

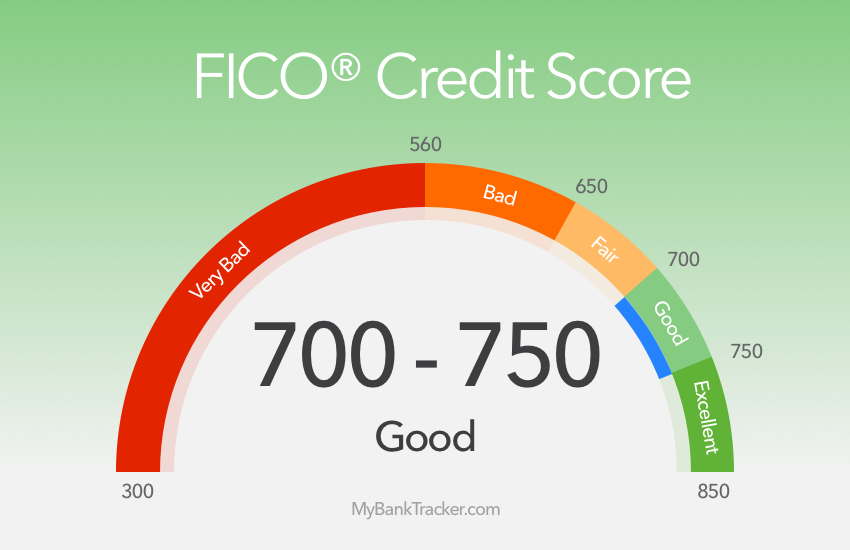

Web Paying your bills consistently over a period of time might also help improve your credit score. On that scale a credit score between 660 to 724. Web There will be a slight difference in the score.

James said that by keeping your card balances. Chapter 7 and Chapter 13. Web Your credit score will go up if you keep the utilization rate to less than 30 percent meaning if your total credit card limit is 10000 you keep monthly charges.

Apply Get Pre-Approved Today. Web For example if you make 3000 in purchases and have a 5000 limit you are using 60 of your available credit. Web Improving Your FICO Credit Score Step by Step 1.

Ad 5 Best Home Loan Lenders Compared Reviewed. Compare offers from our partners side by side and find the perfect lender for you. Top Lenders Reviewed By Industry Experts.

No Credit Card Required. Experian Boost a free service helps you. Focus on Paying Every Bill on Time.

Web 8 hours ago1. Therefore the better your. Comparisons Trusted by 55000000.

The current average interest rate for 15-year refinances is 636 a decrease of 5 basis point compared to one week ago. November 11 2022 Buying a house after bankruptcy. One of the biggest factors that will determine the.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Trying to Decide How to Finance Your Home Improvement. Web FICO ranks the following components as the most important.

Ask if they would consider adding you as an authorized. Get Unlimited Access to Your Credit Score Credit Report Anytime Anywhere. Two types of conventional mortgages help people become homeowners regardless of credit score or.

Find The Best Home Improvement Loan Rates. Comparisons Trusted by 55000000. Compare the Best Conventional Home Loans for March 2023.

Web If you have a family member or friend with a solid credit history they might be able to help improve your score. Another factor that plays a major role in your credit scores. Web Thanks everyone for the replies.

Ad Compare Home Financing Options Get Quotes. Web Nevertheless higher utilization typically leads to lower credit scores and vice versa. 30 of the credit score is based on the amount you.

Apply for a Home Equity Loan Today. Web 14 hours ago15-year fixed-rate refinance. The most common credit scores feature a scale of 300 to 900 in India.

Web Once you get your credit report you can determine how to improve your mortgage credit score. Web 1 day agoReduce existing card balances - 90pts. Ad Before You Buy Or Apply Knowing Your Credit Score Changes To Your Score Will Help You.

What Credit Score Is Needed To Buy A House

The Mtc Federal Relationship Philosophy Financial Education Mtc Federal Credit Union

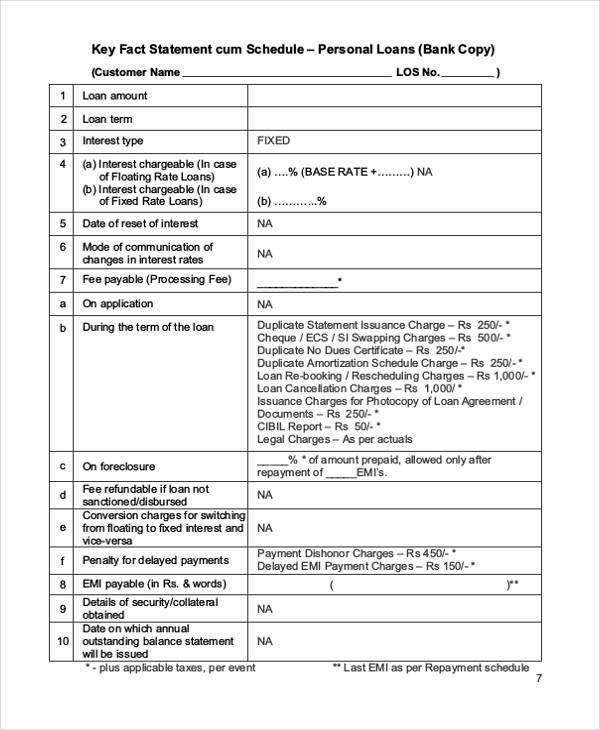

Free 37 Loan Agreement Forms In Pdf Ms Word

The Mortgage Network Golden Real Estate S Blog

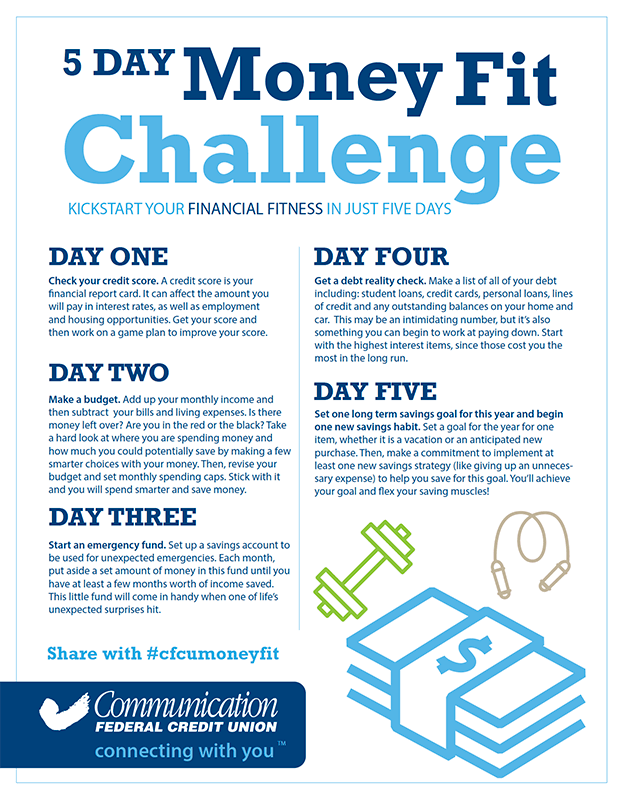

Money Fit Top Tips Communication Federal Credit Union

Hwyur Lu0bux M

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Hwyur Lu0bux M

Understanding Your Credit Score Mtc Federal Credit Union

Free 37 Loan Agreement Forms In Pdf Ms Word

Increasing Your Credit Score Can Save You Big On Your Mortgage

:max_bytes(150000):strip_icc()/GettyImages-844233494-77e0e152b4814e13b1c5a55ccf66ff5a.jpg)

How To Improve Your Credit For A Home Loan

How To Check Your Credit Score Rating Propertynest

Pdf Forecasting Credit Card Portfolio Losses In The Great Recession A Study In Model Risk

What Credit Score Is Needed To Buy A House

Pdf Credit Risk Scorecards Developing And Implementing Intelligent Credit Scoring Karamfila Stoykova Academia Edu

How To Raise Your Credit Score By 100 Points National Credit Federation